Your new post is loading...

Your new post is loading...

The funding landscape in AR/VR has been defined by large rounds to the exceptionally well-funded Florida-based startup Magic Leap, which has raised nearly $1.4B in venture funding. After raising massive Series B ($542M) and Series C ($780M) rounds, the stealth AR company’s financings tend to distort industry funding trends.

To identify well-capitalized AR/VR startups that aren’t named Magic Leap, we used CB Insights data to see which companies are raising big financing rounds and building war chests to help build out the AR/VR ecosystem, which some theorize could become the next major computing platform.

Topping the list of big AR/VR rounds was Laguna Beach, California-based NextVR, which focuses on virtual reality broadcasts of live events. NextVR recently raised an $80M Series B round.

The next biggest deal went to Palo Alto-based cinematic VR platform Jaunt. The company raised a $65M Series C in September of 2015.

In third was UK-based Blippar, which produces a mobile AR visual search app. Blippar last raised a $54M Series D in March of 2016.

Guy Kawasaki shares the layout for a perfect pitch.

Pitching your startup to investors just might be the most nerve-wracking aspect of starting your new business — well, besides the prospect of losing your shirt.

I get it. The last thing you want to do when you’re sleep-deprived and edgy and suffering startup angst is pitch it over… and over… and over again. It’s actually a pretty helpless feeling, asking strangers to decide on the fate of your new venture. If it’s your first or second venture, there can be a real learning curve, too. It takes time and feedback to get it right.

Presentation guru Guy Kawasaki has put together an infographic that can help make your pitch both more effective and less painful....

On his many failed experiments, Thomas Edison once said, "I have learned fifty thousand ways it cannot be done and therefore I am fifty thousand times nearer the final successful experiment." Elsewhere, we have dug into the data on startups that died (as well as those acquihired) and found they usually die 20 months after raising financing and after having raised about $1.3 million. So we thought it would be useful to see how startup founders and investors describe their failures. While not exactly “50,000 ways it cannot be done,” below is a compilation of startup post-mortems that describe the factors that drove a startup’s demise. Most of the failures have been told by the company’s founders, but in a few cases, we did find a couple from competitors, early employees, or investors including Roger Ehrenberg (now of IA Ventures) and Bruce Booth (Atlas Venture). They are in no particular order, and there is something to learn from each and every one of them....

What do the Huffington Post, “The Simpsons,” Minecraft, and Led Zeppelin’s first album have in common?

All of them started as experiments. The Huffington Post was launched in the mid-2000s as a link list and blogging site, leveraging the celebrity network of co-founder Arianna Huffington for content. The Simpsons began in 1987 as short animated clips shown during the commercial breaks of a sketch comedy show on the upstart Fox television network. Minecraft was created in 2009 by a Swedish game programmer, Markus “Notch” Persson, as a part-time project. Led Zeppelin I was recorded in a few weeks in 1968 after the British rock band toured Scandinavia, with production self-funded by guitarist Jimmy Page and the band’s manager.

When the artists, creators, and producers launched these experiments, there was no guarantee they would do well. But the way they innovated greatly increased the chances of success. They moved fast, used low-cost methods of production, and kept the teams small. When they released early versions to the public, they paid close attention to what audiences liked—and didn’t like. This feedback could be incorporated into subsequent releases, and could also help drive marketing and business decisions.

All of the examples listed above are examples of what I call lean media. While their creators went on to enjoy great success, lean media is not just the domain of superstars. Lean media methods can be applied to products designed for niche or local audiences, or products that have a short shelf-life....

For companies like Zenefits, the very name unicorn–a venture-backed private company sporting a valuation above $1 billion–carries irony. The term derives from historic rarity: the idea that an eBay or a Google or a Facebook is a kind of magical occurrence, one that single-handedly turns a portfolio into a blockbuster, a venture capitalist into a superstar. Now it’s a downright common benchmark and one that’s invoked with a sense of dread as their numbers grow. We count 140 unicorns globally, up from 75 at the end of last year. Most are U.S. firms, but it seems like a new one is minted every week or two in China or India.

Unicorns, critics say, represent the next risk bubble: so many largely unprofitable firms lacking in rigorous auditing or public disclosures. “We may be nearing the end of a cycle where growth is valued more than profitability,” veteran venture capitalist Bill Gurley of Benchmark tweeted in August. “It could be at an inflection point.” Skeptics point to the mediocre post-IPO performance of former unicorns Pure Storage and Box as evidence that the chickens have come home to roost. Reports of startups with unworkable business models surface with increasing frequency....

Investing in startups is like bird-watching, or at least that’s the quote from legendary venture capitalist Mike Moritz.

Over the past two weeks, I have listened to 146 startups pitch in rapid-fire succession at demo days for Y Combinator and 500 Startups.

Of those startups, probably five or six will emerge as the next Airbnb, Dropbox, or Reddit. The founders of the next billion-dollar startup have probably run through their pitch deck in front of me.

The rest of the flock will disappear from the sky, selling to a bigger company, going adrift, or maybe shutting down entirely.

For venture capitalists, Moritz advises not to look at the flock, but at each individual startup. “Each one is different, and I try to find an interestingly complected bird in a flock rather than try to make an observation about an entire flock,” Moritz has said.

But you can still learn a lot from watching the entire group. Here’s what this batch of companies showed about the direction startups are flying:...

The last 48 hours of my life were total madness. This is what I did.

Since I’m involved with startups on a daily basis, working on product development and (business) strategy, I’ve always been keeping lists of interesting tools and resources that could be interesting to use. Thinking of something I could create, I thought it would be fun to build a simple and useful site that could help makers find resources and tools while building their startup.

The first thing I did was writing down all categories I could think of that would suit a startup’s needs. I ended up with 50, and made a huge Excel sheet where I entered all the stuff I’d already saved. From there on I started collecting more resources and filling up the empty spaces....

...And so while we have dug into the data behind startups that have died (as well as those acqui-hired) and found they usually die 20 months after raising financing and after having raised about $1.3 million, we thought it would be useful to see how startup founders and investors describe their failures.

While not 50,000 ways it cannot be done, below is a compilation of startup post-mortems that describe the factors that drove a startup’s demise. Most of the failures have been told by the company’s founders, but in a few cases, we did find a couple from investors including Roger Ehrenberg (now of IA Ventures) and Bruce Booth (Atlas Venture). They are in no particular order, and there is something to learn from each and every one of them....

Respected venture capitalist Bill Gurley is sounding the alarm on the startup industry.

In an interview with The Wall Street Journal, Gurley says the current environment reminds him of the tech bubble that formed in the late 1990s.

Every incremental day that goes past I have this feeling a little bit more. I think that Silicon Valley as a whole or that the venture-capital community or startup community is taking on an excessive amount of risk right now. Unprecedented since ‘'99. In some ways less silly than '99 and in other ways more silly than in '99.

Gurley adds, "No one's fearful, everyone's greedy, and it will eventually end."

Gurley is a partner at Benchmark. He's invested in Uber, OpenTable, and Zillow. Benchmark has invested in Snapchat, Quip, Yelp, and many more.

Private companies are raising giant sums of money — some as much as $500 million, says Gurley. When you have that much money, you have to spend it, so companies are upping their "burn rate," or the amount of money they're willing to lose to grow their businesses....

Good set of content marketing tips for the founder of Sparta (http://spartasales.com), a SaaS product that helps sales managers drive sales performance via web based sales contests.

Growth Hackers is a great source of advice for startups, marketing pros and small business.

Klout has attracted it share of critics but it is also an undoubtedly useful tool for businesses trying to achieve a culture of content creation.

Our team needed to establish metrics that would drive the right behaviors in the organization over the long-term. But how do you measure cultural change? How do you measure whether a team is moving from a comfort level with advertising and broadcasting to one of listening, creating, responding, and nurturing an audience of relevant healthcare influencers?

We looked at a variety of metrics but the more we thought about it, “Klout” seemed to fit the bill.I know I risk a torrent of critical responses by even mentioning the name of this company. But if you already on the brink of a rant, I would like to ask a favor. I am taking my time to create free, thought-provoking content for you. Before you rant about Klout in the comment section, please put pre-conceived notions aside for just one moment and don’t skim the article. Then, you can rant : )...

An anonymous startup founder has created a Tumblr blog called "My Startup has 30 Days to Live."We found the blog thanks to a tweet from Monty Munford.On the site, the startup founder says : "Through a series of unfortunate events, I took a bootstrapped (and profitable) startup onto the VC rocket ship. Now it's crashing into the ground. Hard."...

|

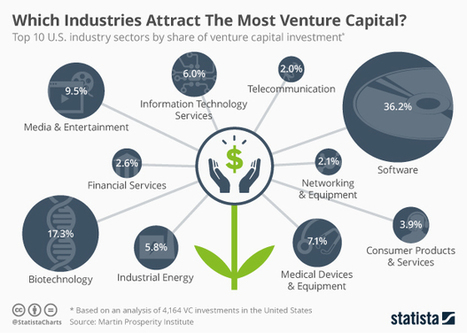

According to a report from Martin Prosperity, venture capital investment is heavily concentrated across several industral sectors. America's top five industries account for 76.3 percent of all VC investment across the nation, about $25 billion in total. Software receives the largest slice of the VC pie by far, accounting for 36.2 percent (almost $12 billion) while biotechnology comes second with 17.3 percent ($5.7 billion). Media and entertainment rounds off the top three with 9.5 percent ($3.2 billion)....

I just did what no startup founder is ever supposed to do.

I gave up.

It wasn’t even one of those glorious “fail fast and fail forward” learning experiences. After seven months of hard work and two weeks before we were to start fundraising, we had a good team, glowing praise from beta users, and over $250k in handshake commitments. But I pulled the plug.

My team and most of my investors are pissed, but I’m sure I did the right thing. At least I think I’m sure.

The business had what I considered to be an unfixable flaw. My investors and my team wanted us to take the funding and figure out how to fix the problem before the money ran out. I’ve started four companies in the past with a mixture of exits and bankruptcies, so I understand that this is what startups are supposed to do, but I just couldn’t do it this time.

This article is in part my explanation to the various stakeholders, in part self-therapy, and in part a call to other founders and investors to let me know what they would have done in my situation.

Global delivery company DHL started its business by offering free plane tickets to people on the street. For the trouble of giving up their baggage allowances, passengers were handed a free round-trip plane ticket to Hawaii.

Founded as a courier service in 1969, DHL used the spare capacity in travelers’ luggage to transport high-value documents. To understand why it made sense for DHL to provide free tickets to travelers, it helps to understand the massive changes entailed by the containerization of ocean cargo in the 1960s.

The world’s most prestigious startup accelerator Y Combinator published a guide to founding companies called The Startup Playbook. Here are the top tips from YC’s president Sam Altman, accompanied by illustrations from Gregory Koberger.

Some call it growth hacking. Others call it optimization. But what we’re all talking about, really, is crazy smart, innovative, results-driven, product-focused marketing that has an outsized impact on your company’s growth and bottom line.In certain circles, the term of art is traction.

Traction is what separates fledgling startups from international brands and it’s the name of a one-day, one-track event that brought dozens of founders and growth champions from tech giants like Twitter, LinkedIn, Dropbox, Hootsuite, Marketo, HubSpot, and PlentyofFish to Vancouver last month.

The day was filled with actionable insights and examples of how small tests, tweaks, and tactics can make or break your business. Here are some of our key takeaways....

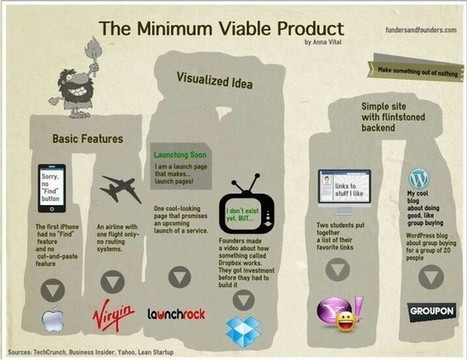

Buffer is an excellent example that supports this ideology. During their development phase, they began by tweeting, the two-page MVP to get their first share of validation from customers. They further shared the pricing model within their community, just to make sure that people would actually buy the product. Over time, they have made many course corrections to the product. In fact, they have explained the detailed process in this interesting post.

Creating a MVP is difficult and many may want to introduce only the best product to users. But believe me this will not help you in any way....

After launching Netscape 20 years ago, Marc Andreessen has had a remarkable second act as a successful and prolific venture capitalist. His firm's portfolio includes some of Silicon Valley's most enviable investments, including Facebook, Airbnb, Twitter, Jawbone, Lyft, Pinterest, and Zenefits. On Wednesday, the super VC and avid Twitter user spoke with Bloomberg TV's Emily Chang at Salesforce's Dreamforce conference in San Francisco, revealing to the audience some lessons he tries to instill in the startups he invests in....

No surprise that Microsoft just bought Mojang, the company behind the hit game Minecraft, for $2.5 billion. We told you about that last week.

The shock is that the tiny team at Mojang — which has fewer than 30 workers — employs someone with the ability to write the world’s best hey-we-just-sold-out letter, directed at the game’s many passionate fans — the ones who will determine whether Microsoft got a bargain or bubble-inflated dud.*

If you’re ever in a position to announce that you’ve sold your company for $2.5 billion, or any sum, you should be taking notes.

Here’s a free head start....

Garthen Leslie is an IT consultant and looks the part. He's geeky, quiet, and middle-aged, sporting a long, untucked white polo, khakis, and wire-framed glasses. But today, very suddenly, he is also the face of a new ideal--a symbol of how invention itself is being reinvented.

"It was August and really hot," Leslie says, recalling how it all began, as he reaches for an hors d'oeuvre at a media-saturated party being thrown in his honor in Manhattan's Chelsea neighborhood (Martha Stewart will amble through the door in about 15 minutes). The 63-year-old had been commuting from Washington, D.C., to suburban Maryland, dreading the hellishly stuffy home that awaited him--but he didn't want to leave his AC on all day, for fear of an equally hellish energy bill. "I thought, There are all kinds of applications forsmartphones," he says. "Why couldn't we marry one to these window air conditioners?" He dreamt up a device that did just that and submitted it to a New York startup called Quirky, which turns great ideas into best-selling products...

So you have a great idea for a new mobile app or Web service—but you don’t know anything about coding or developing. You might have started searching for a tech-oriented co-founder to help you launch your idea, only to find that your startup can’t afford the ongoing salary for a skilled software developer.

The question is: Does a startup need permanent tech staff right away or can you get things off the ground without one? This four-step plan will help you move from idea to full-fledged business, without the need for massive startup capital....

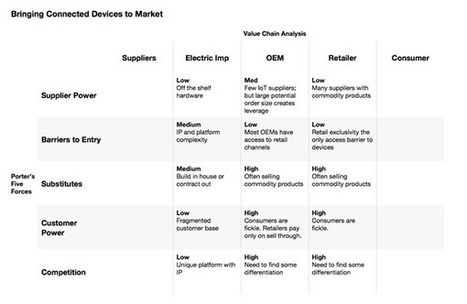

When I first started in venture capital five years ago, I wanted to create a programmatic way to analyze companies well. My goal was to be able to step into a meeting with an entrepreneur with some kind of form that I would fill out throughout the meeting, so that by the end of the meeting I might have an understanding how the startup fits into its ecosystem.

It took quite a while to devise this framework and to revise it until it became useful, practical and insightful. I spoke with friends who were consultants and who analyze companies for a living. I read many books on the topics of competition and strategy. Last, I spoke with other investors.

But in the end I chose three simple frameworks that were already well-known and which fit together on two sheets of paper: The Business Model Canvas, Porter’s Five Forces, and Value Chain Analysis....

A little over six months ago two young journalists sat down at Google Campus in London and discussed how to build a news site for 18 to 25-year-olds with articles written by people in that age category. Under the mantra "don't publish anything boring", Planet Ivy has grown into a site with a network of more than 150 young writers publishing around 80 articles a week between them and reaching up to 400,000 unique users a month. Six months on and back in at Google Campus, where the three paid employees of Planet Ivy are based, the founder and the editor of the title told Journalism.co.uk about the site's model and how they have received investment from an angel investor and from Ascension Ventures....

|

Your new post is loading...

Your new post is loading...

CB insights always has valuable perspectives on venture capital, startups, disruptors and industries ready to grow. This report looks at 15 startups in the artificial reality/virtual reality space and it's fascinating.