Your new post is loading...

Your new post is loading...

The funding landscape in AR/VR has been defined by large rounds to the exceptionally well-funded Florida-based startup Magic Leap, which has raised nearly $1.4B in venture funding. After raising massive Series B ($542M) and Series C ($780M) rounds, the stealth AR company’s financings tend to distort industry funding trends.

To identify well-capitalized AR/VR startups that aren’t named Magic Leap, we used CB Insights data to see which companies are raising big financing rounds and building war chests to help build out the AR/VR ecosystem, which some theorize could become the next major computing platform.

Topping the list of big AR/VR rounds was Laguna Beach, California-based NextVR, which focuses on virtual reality broadcasts of live events. NextVR recently raised an $80M Series B round.

The next biggest deal went to Palo Alto-based cinematic VR platform Jaunt. The company raised a $65M Series C in September of 2015.

In third was UK-based Blippar, which produces a mobile AR visual search app. Blippar last raised a $54M Series D in March of 2016.

For companies like Zenefits, the very name unicorn–a venture-backed private company sporting a valuation above $1 billion–carries irony. The term derives from historic rarity: the idea that an eBay or a Google or a Facebook is a kind of magical occurrence, one that single-handedly turns a portfolio into a blockbuster, a venture capitalist into a superstar. Now it’s a downright common benchmark and one that’s invoked with a sense of dread as their numbers grow. We count 140 unicorns globally, up from 75 at the end of last year. Most are U.S. firms, but it seems like a new one is minted every week or two in China or India.

Unicorns, critics say, represent the next risk bubble: so many largely unprofitable firms lacking in rigorous auditing or public disclosures. “We may be nearing the end of a cycle where growth is valued more than profitability,” veteran venture capitalist Bill Gurley of Benchmark tweeted in August. “It could be at an inflection point.” Skeptics point to the mediocre post-IPO performance of former unicorns Pure Storage and Box as evidence that the chickens have come home to roost. Reports of startups with unworkable business models surface with increasing frequency....

Respected venture capitalist Bill Gurley is sounding the alarm on the startup industry.

In an interview with The Wall Street Journal, Gurley says the current environment reminds him of the tech bubble that formed in the late 1990s.

Every incremental day that goes past I have this feeling a little bit more. I think that Silicon Valley as a whole or that the venture-capital community or startup community is taking on an excessive amount of risk right now. Unprecedented since ‘'99. In some ways less silly than '99 and in other ways more silly than in '99.

Gurley adds, "No one's fearful, everyone's greedy, and it will eventually end."

Gurley is a partner at Benchmark. He's invested in Uber, OpenTable, and Zillow. Benchmark has invested in Snapchat, Quip, Yelp, and many more.

Private companies are raising giant sums of money — some as much as $500 million, says Gurley. When you have that much money, you have to spend it, so companies are upping their "burn rate," or the amount of money they're willing to lose to grow their businesses....

...For example, many evolving markets are seeing the “death of the middle.” The winners in these markets either offer the broadest breadth or the deepest depth. In evolving markets neither the broadest nor deepest is in trouble, but the middle market is withering. So it is logical to expect the big winners in the news business to either be the broadest or the deepest: To go maximum mass, or maximum specific.

With that as a backdrop, here are eight obvious business models for news now, and in the future. This isn’t a pick one model and stick with it prospect, news businesses should mix and match as relevant....

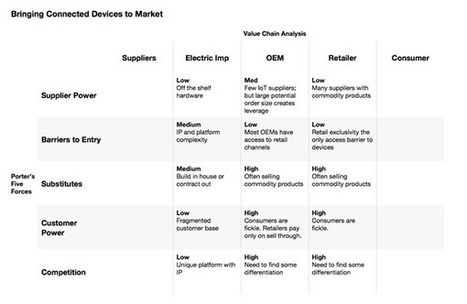

When I first started in venture capital five years ago, I wanted to create a programmatic way to analyze companies well. My goal was to be able to step into a meeting with an entrepreneur with some kind of form that I would fill out throughout the meeting, so that by the end of the meeting I might have an understanding how the startup fits into its ecosystem.

It took quite a while to devise this framework and to revise it until it became useful, practical and insightful. I spoke with friends who were consultants and who analyze companies for a living. I read many books on the topics of competition and strategy. Last, I spoke with other investors.

But in the end I chose three simple frameworks that were already well-known and which fit together on two sheets of paper: The Business Model Canvas, Porter’s Five Forces, and Value Chain Analysis....

|

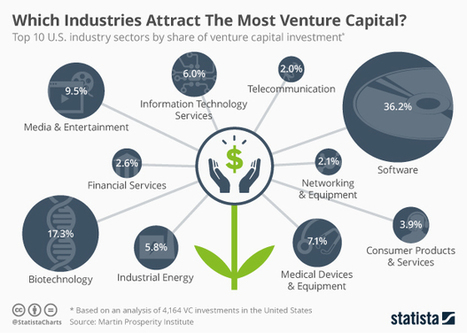

According to a report from Martin Prosperity, venture capital investment is heavily concentrated across several industral sectors. America's top five industries account for 76.3 percent of all VC investment across the nation, about $25 billion in total. Software receives the largest slice of the VC pie by far, accounting for 36.2 percent (almost $12 billion) while biotechnology comes second with 17.3 percent ($5.7 billion). Media and entertainment rounds off the top three with 9.5 percent ($3.2 billion)....

Investing in startups is like bird-watching, or at least that’s the quote from legendary venture capitalist Mike Moritz.

Over the past two weeks, I have listened to 146 startups pitch in rapid-fire succession at demo days for Y Combinator and 500 Startups.

Of those startups, probably five or six will emerge as the next Airbnb, Dropbox, or Reddit. The founders of the next billion-dollar startup have probably run through their pitch deck in front of me.

The rest of the flock will disappear from the sky, selling to a bigger company, going adrift, or maybe shutting down entirely.

For venture capitalists, Moritz advises not to look at the flock, but at each individual startup. “Each one is different, and I try to find an interestingly complected bird in a flock rather than try to make an observation about an entire flock,” Moritz has said.

But you can still learn a lot from watching the entire group. Here’s what this batch of companies showed about the direction startups are flying:...

Here's where to find the next big thing.

Product Hunt, founded by Ryan Hoover, is used by a lot of familiar names in Silicon Valley and New York: Greylock Partners, Andreessen Horowitz, Raptor Ventures, Betaworks, SV Angel, Y Combinator, 500 Startups (Dave McClure), Techstars, Index Ventures, First Round Capital, Google Ventures (Kevin Rose, MG Siegler), Dave Morin, VaynerRSE, Cowboy Ventures, Ashton Kutcher, Greycroft, Andrew Chen and others.

The site looks like Hacker News or Reddit, with up-votes to signal which new products are most popular. But instead of sorting through news articles or photos, Product Hunters can expect to find apps that have just bubbled up, like a crowd-sourced Google Play or App Store.

And what isn't content?

In an article yesterday on another financing in content marketing, Re/code’s Peter Kafka raised some legitimate questions about what’s going on here, why this a real challenge for marketers, and how big the potential for the space actually is. Or, as he put it: “What is content marketing again, and why is it a thing people are fighting over?”

If Peter is asking these questions, that means there are many more folks in and around the technology industry wondering the same thing....

Since Peter really asked three questions, I’m going to approach them one at a time. “What is content marketing,” why is “finding something to say to [their] followers” a challenge for marketers and is this “a market that grows beyond a certain size”?...

...There are plenty of content marketing specialists out there offering advice and content writing, but alongside these are more and more software-as-a-service platforms with nifty solutions for curating, publishing and automating the distribution of content – all adopting slightly different business models to take a slice of this growing market.

Venture Capitalists have invested heavily in these SaaS start-ups in the past 12 months – alongside growing mergers and acquisitions by the large media players eager to participate in the trend. Below we take a look at some of the recent investments and investors and where that money is being focused....

|

Your new post is loading...

Your new post is loading...

CB insights always has valuable perspectives on venture capital, startups, disruptors and industries ready to grow. This report looks at 15 startups in the artificial reality/virtual reality space and it's fascinating.